5 Tips on how to get out of debt and into your own home!

General Trish Pigott 28 Jun

General Trish Pigott 21 Jun

Are you wanting to access the equity in your home? If so you need to read this fantastic article. It provides a better picture of what it looks like to refinance in 2018. The mortgage world is ever changing, with new rules being implemented what seems to be regularly. It is our job to stay on top of these changes and keep you well informed. If you have any mortgage related questions, please do not hesitate to reach out to us directly at 604.552.6190. We would love to navigate you through these constant changing waters!

General Trish Pigott 14 Jun

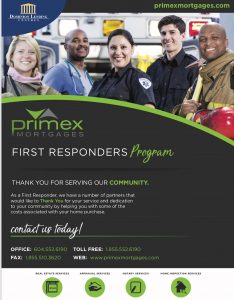

Are you or someone you know a First Responder? If so, you have to contact our office 604-552-6190 to find out about our amazing First Responder Program!! We have teamed up with other like minded individuals in this industry to help save you money around the costs with purchasing or refinancing.

General Trish Pigott 7 Jun

We are always looking for ways to save you money and ensure you have the best products when it comes to home ownership. Whether your home insurance is expiring next month or next year, just like a mortgage, don’t sign on the dotted line without shopping first. We have a partner that will do that for you.

I personally tried it when my home insurance with TD was up for renewal and the process was so easy, a quick 5 minute email and within a day I had a quote back from Canada’s top 3 insurers on one simple page and I saved over $200 with better coverage.

Take the time, it’s worth it and there is no obligation or cost in getting the quote. If you have any questions or would like to discuss it, please contact my office and I will be happy to chat more about it.

General Trish Pigott 1 Jun

The Bank of Canada did indicate that we will most likely see an increase later this year, possibly July and maybe again at the end of the year. With that being said, there are many indicators that they will continue to monitor to see if that will in fact be the case.

Banks are more aggressive than ever with the discount clients are receiving off of prime for variable rates. With a few lenders offering Prime minus 1% and even better with some banks, this is a great option for home owners and home buyers. Over the past 5 years we have experienced record low fixed rates which has led a lot of people into that territory but with the variable rate being so attractive again, people will pay far less interest in a variable rate mortgage than they will with a fixed in current market conditions.

CLICK HERE to read the full report from our economist Dr. Sherry Cooper

If you would like some advice and direction on whether a variable rate may be good for you, please contact me directly and I will be happy to review your current situation.