With the recent changes in interest rates by the Bank of Canada, variable-rate mortgage holders have started to panic. We wanted to address these concerns, to assure you that the sky is not falling. Despite what you see in the news, you do not need to panic! There is still lots of opportunity in this market.

Inflation across North America is affecting everyone. On June 15th, the U.S. Federal took an aggressive step of boosting its interest rate by 0.75%. Federal Reserve Chair, Jerome Powell, also indicated there could be more, bigger-than-normal, increases in the future.

The U.S. increase follows a 0.5% rate increase by the Bank of Canada at the beginning of June. Both central banks are engaged in a serious fight to bring inflation back to a 2% target. Right now, inflation is nearly 7% in Canada and almost 9% in the U.S. This month’s hike by the U.S. Fed is leading many to believe that Canadians may see another 0.75% increase sometime this year.

This information does not help relieve anxiety from homeowners here in Canada, as a recent survey from Manulife suggests more than 20% of Canadians expect rising rates to have a negative effect on their mortgage, debt, and financial situation. Few Canadians “feel prepared for rising rates.”

However, these fears may be the result of a lack of knowledge rather than any real risk. This survey conducted by Manulife also reveals that nearly a third of respondents admit that they do not understand how inflation or interest rates work. Many do not have a household budget or a written financial plan. This is critical in planning for the future of rising rates in your household.

Want to understand more about our economy and inflation? CLICK HERE to check out this report from Dr. Sherry Cooper, our Chief Economist.

Here are 5 tips to help plan for the future:

1. First, contact us if you would like your mortgage reviewed. We can quickly spot different ways to help improve your monthly cash flow including changing your payment frequency or extending your amortization.

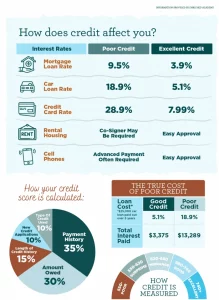

2. Consider a debt consolidation – this can save you thousands in unsecured debts with high-interest by rolling them all into one monthly payment.

3. Prepare a monthly household budget – This is lacking in the majority of Canadian households! CLICK HERE to get started on tracking your expenses and ensuring your hard-earned income is going to the right places.

4. Hold off on unnecessary purchases for now. No matter how big or small, now is the time to reign it in.

5. Increase your payments to absorb rising rates if you are in a variable rate mortgage and worried about future payment increases.

Please share this with your friends, family or coworkers who are feeling worried about the rate changes and their current financial situation. We can help put them at ease! And don’t hesitate to contact us with any questions. When in doubt, call us at 604-552-6190 and we will help ease your stress!