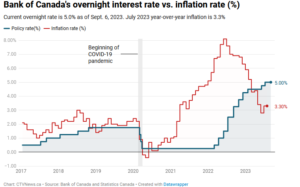

As you may have heard, The Bank of Canada’s policy rate was 5% as of September. The recent rate hikes over the spring and summer have slowed the housing and mortgage markets as the rise in mortgage rates unsurprisingly spooked potential buyers. More recently, fixed-rate loans have become more expensive because of the increase in longer-term interest rates. As a result, housing affordability became a more significant hurdle and led to a slight decrease in home prices by 6% in major markets over the summer.

With The Bank of Canada currently maintaining the 5% policy rate, many hope this will be the peak in overnight rate changes. If so, homeowners and potential buyers will be granted some breathing room. We will find out more with their upcoming announcement on October 25th.

Analysts forecast stronger housing markets as we turn the corner into Fall and start looking ahead to the coming year. The expectation is that The Bank of Canada will gradually cut interest rates by mid-year, allowing potential buyers to navigate their affordability better.

As the supply shortage continues, new listings will likely rise and provide much-need inventory. As we move into 2024 and see interest rates decrease, motivated sellers will roll off the sidelines, and housing demand is expected to be resilient.

For anyone thinking about purchasing this season, getting pre-approved to guarantee your interest rate for 90-120 days while you shop the market is essential. This way, you will avoid being impacted by potential rate changes and can adequately estimate your budget for mortgage costs. Plus, pre-approval will indicate to the seller that you will be fine with obtaining financing (assuming nothing changes between now and the purchase with your job, savings, etc.), which is crucial during the current economic landscape.

To help you make the best decision possible, download the My Mortgage Toolbox app to determine what you can afford, and what your mortgage would look like at various interest rate levels.

If you are looking for mortgage assistance or would like to start the pre-approval process, you can email us at support@primexmortgages.com, or you can book a call with Trish!

Trish & The Primex Team!

Today the Bank of Canada announced a pause in their rate hikes, leaving its policy unchanged. Which also means no change to current mortgage payments if you have a Variable Rate Mortgage.

Today the Bank of Canada announced a pause in their rate hikes, leaving its policy unchanged. Which also means no change to current mortgage payments if you have a Variable Rate Mortgage. Canada’s annual inflation rate ticked back up to 3.3% in July from its 2.8% the month before. The Bank of Canada warned that they expect inflation to be higher in the near term thanks to rising gasoline prices.

Canada’s annual inflation rate ticked back up to 3.3% in July from its 2.8% the month before. The Bank of Canada warned that they expect inflation to be higher in the near term thanks to rising gasoline prices. “We might not fall into the official recession definition, but it’s going to be a close run for sure,” Porter said.

“We might not fall into the official recession definition, but it’s going to be a close run for sure,” Porter said.