When purchasing a home, most offers include conditions or subjects, which are requirements or criteria to be met before the sale can be finalized and the property is transferred. Some of the most common subjects include:

- Financing approval

- Home inspection

- Fire/home insurance protection

- Strata document review if appliable

The purpose of these subjects is to protect the buyer from making a poor investment and ensure no hidden surprises regarding financing, insurance, or the state of the property.

These conditions are written up in the purchase offer with a removal date. The seller agrees to this before the sale is finalized. The deal can go through, assuming the subjects are lifted by the removal date. If the subjects are not lifted (perhaps financing falls through or something is revealed during the home inspection), the buyer can waive the offer, and the purchase becomes void.

However, recently, especially in heightened housing markets, subject-free (or condition-free) offers have emerged. These are purchase offers that are submitted without any criteria required! Essentially, what you see is what you get.

Below we have outlined the impact of subject-free offers on both buyers and sellers to help you better understand the risks and outcomes:

Pros of Subject-Free Offers

- Buyers: The main benefit of a subject-free offer for a buyer is the ability to “beat the competition” in a heated market. However, it is not without risks.

- Sellers: Typically, a subject-free offer will include a competitive price, willingness to work with the dates the seller prefers, and evidence that the buyer has already done as much research as possible. If time is sensitive for the seller because they are trying to purchase another home or want to move as soon as possible, they may also choose your offer over subject offers to expedite the process.

Cons of Subject-Free Offers

- Buyers: As a buyer submitting a subject-free offer, you are assuming a great deal of risk in several areas, including financing, inspection, and insurance:

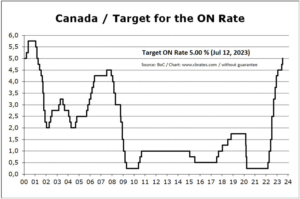

- Financing: While buyers may feel that they have a pre-approval, so they don’t require a subject to financing, it is crucial to recognize that a pre-approval is not a guarantee of funding. If you submit a subject-free purchase based on a pre-approval, buyer beware. The financing is subject to the lender approving the property and the sale, from the price and location to the property type or other variables the lender deems essential. By submitting a subject-free offer without a financing guarantee (or an inspection, title check, etc.), there is a risk that the deal can fall through. Even when you do not include subjects on the offer, you still are required to finance your purchase. In addition, as sales are typically submitted with a deposit, there is a risk that the buyer will lose their deposit if the subject-free offer falls through. This amount can vary in the thousands and is typically a percentage of the purchase price or down payment.

- Inspection & Insurance: If a buyer is also opting to skip the home inspection and home insurance protection subjects to have the offer accepted, then they assume massive risk as they do not know what they are getting and whether or not the property is up to code for insurance.

- Due Diligence: With subject-free offers, there is no opportunity for due diligence after the offer. This requires the buyer to do all their research before their initial bid. Because it is firm and binding, a buyer who decides to back out will likely be met with severe legal ramifications. Submitting an offer without subjects is not due diligence and is at the buyer’s behest.

- For Sellers: When it comes to the individual selling the property, there is less risk with subject-free offers but not zero. While the benefit is essentially there is no wait to accept the offer on the seller’s side, they do not know for sure if financing will come through.

Financing Around Subject-Free Offers

When submitting a subject-free offer, it is up to the buyer to do as much due diligence as possible before submitting. They must identify what the lender seeks to ensure they walk away with a mortgage. Though approval is never certain, prospective buyers placing a subject-free offer should do their best to secure financing beforehand.

Contractual Obligations

Be mindful when it comes to purchasing offers versus purchase agreements. While your purchase offer is a written proposal to purchase, the purchase agreement is an entire contract between the buyer and seller. The purchase offer acts as a letter of intent, setting the terms you propose to buy the home. If financing falls through, for example, the contract is breached, where the buyer may lose the deposit.

It is also essential to be aware of a breach of contract if a seller chooses to take action. For example, if you submit a subject-free offer of $500,000 and cannot secure financing for that offer, and the seller turns around and is only able to get a $400,000 deal with another buyer, they could potentially sue the initial buyer for the difference due to breach of contract.

Preparing a Subject-Free Offer

If you have decided to go ahead with a subject-free offer, regardless of the risks, there are some things you can do to mitigate potential issues, including:

- Get Pre-Approved: Again, this is not a guarantee of financing when you make an offer, but it can help you determine whether you would be approved.

- Financing Review: Identify what the lender seeks to ensure they walk away with a mortgage. Though approval is never certain, prospective buyers placing a subject-free offer should do their best to secure financing beforehand.

- Do Your Due Diligence: Look into the property and determine if there have been significant renovations or a history of damage. This could come in the form of a Property Disclosure Statement. While this statement cannot substitute a proper inspection, it can help identify potential issues or areas of concern. If possible, conduct an inspection before submitting your bid/offer.

- Get Legal Advice: This can help you determine your potential risk and ramifications of the offer, should it be accepted or otherwise.

- Title Review: Be sure to review the title of the property.

- Insurance: Confirm that you can purchase insurance for the home. Remember that an inspection may be required for this, but in some cases, you can substitute for a depreciation report if it is recent.

- Strata Documents (if applicable): Thoroughly review strata meeting minutes and related documents to determine areas of concern.

While there are things that can be done to help with subject-free offers, it is still risky. Ultimately submitting an offer with subjects gives you the time and ability to gather information on the above and access to the property or home for inspections.

Before making any offers, get a Pre-Approval in place so you can make the best decision. If you are intent on submitting a subject-free offer, discuss it with your real estate agent, as they can determine if a subject-free offer is necessary or if a short closing window would suffice to seal the deal. A good realtor will also keep you informed of potential interest and other bids during the process. Their goal should be to maximize your opportunity and minimize your risk.

Getting ready to put an offer in on your dream home? Call us first, we have many strategies to help shorten the traditional subject period and make your offer more competitive without going subject free to protect yourself.

604-552-6190

Trish & The Primex Team