Even though Fall has already started, there are a few things you can do still to ensure your home is well-prepared for the season:

- Examine Your Gutters: This time of year it is important to clean and inspect your gutters (replacing as needed) to ensure they are working properly as the rain and snow season hits. If they are clogged or damaged, it could result in flooding or exterior damage – so don’t wait!

- Check for Drafts: In the Fall and Winter, many homeowners are spending extra money heating their homes due to drafts, but it doesn’t have to be that way! Do a check on all exterior doors and windows to confirm if they are properly sealed. To do this, simply close a door or window on a strip of paper. If the paper slides easily, you need to update your weatherstripping.

- Inspect Your Furnace: We are no strangers to chilly evenings! To ensure you are comfortable throughout the colder months, be sure to have your furnace inspected by an HVAC professional. They can check leaks, test efficiency, and change the filter. They can also conduct a carbon monoxide check to ensure air safety.

- Manage Your Thermostat: As tempting as it is to turn your heat all the way up in the winter, proper thermostat management will help you save costs in the long run. Using a thermostat with a timer can save you even more. Turn them on earlier so the room heats up in time for use and have it turned off 30 minutes before bed or before leaving the home. If you find you are still chilly at night, a safely positioned space heater and closed door is an inexpensive solution.

- Fix Any Concrete/Asphalt Cracks: This one is easy to ignore thinking it will be fine, but it could easily turn into a bigger issue. When water gets into existing cracks during the colder months it will freeze and expand, causing the crack to become even larger.

- Turn Off Outdoor Plumbing: Since your garden will not need attention until the Spring, it is a good idea to shut off and drain all outdoor faucets and sprinkler systems. Depending on where you live, you might also want to cover them to prevent freezing during the Winter months.

- Change Your Batteries: For safety, it is recommended that you check that all smoke detectors and carbon monoxide devices are working at least a couple of times throughout the year. While doing other Fall home prep, add this one to your list!

- Create a Storm Kit: A storm kit is a handy source of essential items in the event of losing power. Consider what you and your family might need, such as a flashlight with new batteries, candles, matches, a portable radio, water, and snacks. Keep your kit somewhere easy to access.

Whatever your plans this season, a quick check of your home will ensure there are no surprises!

Trish & The Primex Team

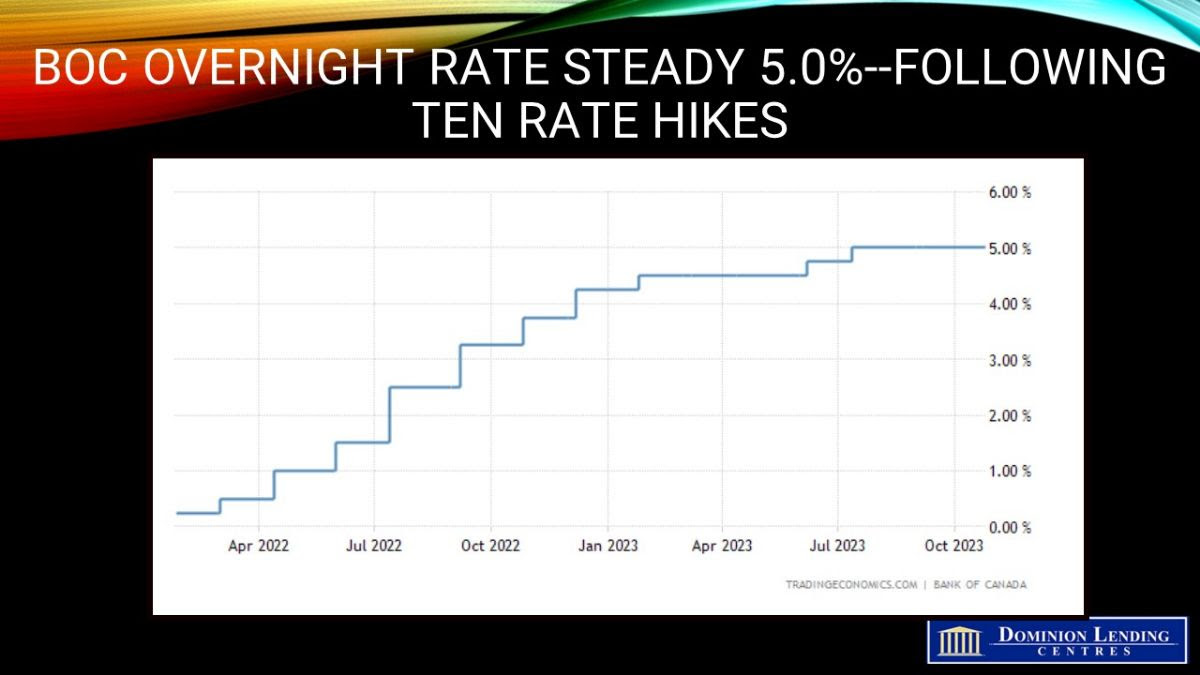

Today the Bank of Canada announced a pause in their rate hikes, leaving its policy unchanged. Which also means no change to current mortgage payments if you have a Variable Rate Mortgage.

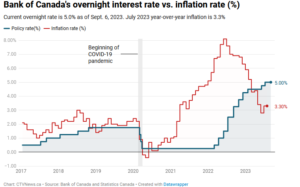

Today the Bank of Canada announced a pause in their rate hikes, leaving its policy unchanged. Which also means no change to current mortgage payments if you have a Variable Rate Mortgage. Canada’s annual inflation rate ticked back up to 3.3% in July from its 2.8% the month before. The Bank of Canada warned that they expect inflation to be higher in the near term thanks to rising gasoline prices.

Canada’s annual inflation rate ticked back up to 3.3% in July from its 2.8% the month before. The Bank of Canada warned that they expect inflation to be higher in the near term thanks to rising gasoline prices. “We might not fall into the official recession definition, but it’s going to be a close run for sure,” Porter said.

“We might not fall into the official recession definition, but it’s going to be a close run for sure,” Porter said.